Blog

1031 Exchange – What Is It and How Does it Work?

The 1031 Exchange can be a powerful tool to build wealth through commercial real estate, as long as you know the rules. How do 1031 Exchanges work and what do you need to know?

What is it?

The 1031 Exchange takes its name from Section 1031 of the IRS code, which allows investors to defer capital gains tax on the exchange of any “like-kind” property. This allows you to use the full proceeds of a sale of a commercial property for the acquisition of another property. The code gives commercial real estate investors the flexibility to consider changing their investment strategies, and allows them to reinvest capital that would otherwise be paid in capital gains taxes.

What Qualifies for a 1031 Exchange?

The definition of “like-kind” is broad. You are allowed to exchange one investment property for another investment property, and defer the capital gains tax on the sale. For instance, you can swap an apartment building for an office building, or a retail center for a storage facility. As long as the properties are both held for investment purposes or for productive use in a business, they are considered like-kind.

Personal assets, like vacation homes, are not considered like-kind to commercial properties, and properties inside the United States are not considered like-kind for properties outside the US. Common sense can guide you, but always check.

What are the Deadlines? What do I Need to Know?

Investors need to adhere to the timelines involved in 1031 exchanges. Not following the rules, or not meeting deadlines, could mean costly tax penalties.

If you are executing a 1031 Exchange, you must identify a replacement property within the first 45 days after the sale of your relinquished property, and the purchase must close within 180 days.

However, the capital gains are only tax deferred – they are not tax free. An investor can continue deferring capital gains on investment properties in 1031 Exchanges until a property is eventually sold for cash – years, or even decades, after the first swap. This makes the 1031 Exchange especially attractive for estate planning and long-term investment strategies.

How did the Tax Bill Affect 1031 Exchanges in CRE?

The 2017 tax bill did not have any effect on 1031 exchanges with respect to commercial real estate. The legislation preserves section 1031 like-kind exchanges. The plan maintains the tax free like-kind exchanges for investment real estate properties, but eliminates them for personal property exchanges and other asset types.

Avoiding Pitfalls

Make sure you set up the exchange properly. The 1031 Exchange is not only a real estate transaction, it’s also a tax transaction. A real estate attorney or exchange company can help you with the paperwork. Always contact your tax and/or legal advisors for professional advice that is consistent with your personal situation.

Another common pitfall is not identifying a replacement property within 45 days of the sale, which is not a long time in real estate terms. The IRS applies the rules strictly and it is very difficult to get extensions. If you think of the 1031 Exchange more like a swap – rather than a separate sale of one property and a separate purchase of another – you can plan accordingly and take advantage of a long-term wealth-building mechanism.

Plum partner Brevitas is a marketplace of commercial properties for real estate investors. They list inventory by property type, location, and price, and can be a good place to start looking for replacement properties.

If you receive cash, you pay taxes. A requirement of the 1031 Exchange is that you cannot receive or control sales proceeds- only a qualified third party can. You must also invest the total proceeds from the sale of the relinquished property. You will be taxed on any money left over or returned to you.

A Qualified Intermediary (QI) can simplify the exchange process by accepting a transfer of your property, conveying it to a buyer, taking custody of the proceeds, buying the replacement property, and transferring the title to you. Plum partner First American Exchange specializes in these types of exchanges. They can answer any questions that you have. They also have an extensive library of resources to assist you.

Related

A quick, smooth loan closing begins before you reach out to a lender. It’s made possible by understanding the type of documentation lenders look for, and when, and in which format, they need to receive it. The type of property being financed will influence key documents; however, the following are items that are consistent across…

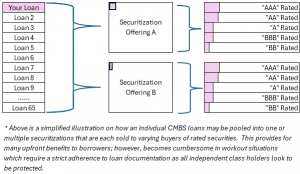

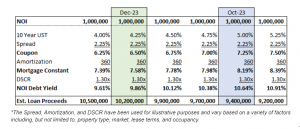

Read More >>CMBS loans have become popular in 2024 as regional and local banks have slowed or halted new loan production. For those that aren’t as familiar with the CMBS product, the loans are heavily structured and largely originated by lenders with little to no customer relationship. The loans are quickly sliced, diced, pooled and converted into…

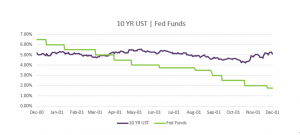

Read More >>While the Fed is an important driver in the economy, it isn’t the only factor that shapes long-term interest rates for commercial real estate. We saw interest rates move independently of the Fed’s actions in the year 2000. At that time, the Fed had abandoned their two year fight against inflation and turned on its…

Read More >>Santa came early for some commercial real estate owners who locked a rate in the past week. The 10YR US Treasury yields dipped then rallied last week, declining to 4.11% before bouncing back to current levels near 4.25%. Is this dip and then increase back to the prior week’s levels a sign of a…

Read More >>CRE Owners Catch a Break This past week, commercial real estate owners caught a huge break. The 10YR treasury yields fell almost 0.30% throughout the week, and are 0.80% lower than their high of ~5.00% in mid October. Not even Friday’s comments by Fed Chair Powell that “rate cuts are premature” stopped yields from…

Read More >>COMPANY

© 2019 PLUM Lending. All Rights Reserved. | Terms of Service | Privacy | Plum, Inc. dba Plum and/or Plum Lending