Blog

2020 Trends: E-Commerce and the Warehousing Sector

“Industrial real estate demand is expected to increase by 850 million square feet, to 14.8 billion square feet, by 2023,” according to Deloitte.

As we enter Q4, our focus in this article is e-commerce and industrial real estate changes in 2019 and into 2020. It comes as no surprise that the new retail, such as Amazon, is shaping the modern industrial industry, but that’s not the only driver that will be leading the industrial industry in 2020.

The State of Industrial Real Estate

2019 was a year of steady growth and stability for industrial real estate. We have seen consistent demand, positive year-over-year rent growth, and lower vacancy rates as we head into 2020. According to Real Capital Analytics, “Industrial property prices have grown faster than inflation across the Americas over the last three quarters. This sort of coordinated growth for industrial prices does not happen often.”

Historically, investors look to the economy in parallel to the health of the real estate industry. However, industrial real estate specifically hasn’t followed the same patterns as the U.S. economy. In 2020, we may see some new economic indicators. Investors are preparing for political and economic uncertainty as the 2020 U.S. presidential election gets closer and issues like labor wages take center stage.

Drivers Affecting Growth in This Sector

In 2020, key drivers for growth will primarily be the changing face of retail, and the demand for fulfillment centers and faster delivery. The need for more industrial space in urban centers will bring about a change in space design to maximize efficiency. Multistory warehouses and more technologically advanced spaces will be emerging trends for successful industrial properties.

The new retail

E-commerce will continue to be a key driver in the growth of the industrial sector. Amazon will continue its domination in this market sector as it opens new fulfillment and distribution centers and more industrial ventures. Retailers will continue to find a balance between brick-and-mortar and digital sales, as consumer purchasing through both retail channels becomes a clearer indicator for warehouse demand.

According to Deloitte, “e-commerce companies need 20 percent more space to manage reverse logistics compared to normal sales. In addition, with e-commerce sales expected to grow at 15 percent annually, reaching 14.8 percent of retail sales by 2023, the number of product returns will increase, requiring more industrial space.”

Multistory warehouses

As retailers compete to make same-day and one-hour delivery more available, there will be a growing need for more logistics centers in urban areas. Due to the square footage constraints with traditional warehouses, developers will likely look at building or expanding upward to accommodate space demands.

CBRE explains that “the key variables for multistory warehouse development are high population density, strong e-commerce penetration and tight market conditions for suitable last-mile fulfillment buildings and development sites.“ Currently, multiple companies like Prologis and Amazon are experimenting with multistory warehouses in the Bay Area, Seattle, and New York City. Multistory spaces will come with higher rents and mostly cater to large corporations.

Transforming Technology

As the way we use industrial space changes, so will the systems and operations that manage it. One of the biggest changes occurring is the implementation of “smart warehouses” and the demand for space that’s technologically compatible.

The demand for warehouse space design will significantly begin to change in the upcoming year as the need for spaces that support new technology grows. Some examples include: self-driving delivery vehicles, automated inventory control, “Internet of Things” (IoT), connected spaces and more use of artificially intelligent technology such as drones and robots. Many tenants will begin to weigh the benefits of technology as well as location and property size.

Outlook

Demand for industrial real estate shows growth in competitive markets and into secondary markets throughout 2020. As demand increases, so will availability, which in the next few years could lead to a less competitive market and more moderate rental and vacancy rates. However, for now and into the near future, demand for industrial isn’t expected to decline soon. Today, owners and investors are focusing on accessible properties and new demands in space design, technology, and operations.

What do you think are the biggest industrial trends to watch in 2020? Connect with us on LinkedIn to join the conversation!

Contact a PLUM loan specialist (contact us form) today to discuss your commercial real estate financing needs, or set up time on our calendar.

PLUM Lending is a full service commercial real estate lender that provides creative structured finance solutions for all property types. We specialize in the capitalization of middle-market commercial real estate properties nationwide with a focus on secondary markets. We provide borrowers with capital through our various direct lending programs as well as access to construction financing, mezzanine capital, and preferred and joint-venture equity investments.

Related

A quick, smooth loan closing begins before you reach out to a lender. It’s made possible by understanding the type of documentation lenders look for, and when, and in which format, they need to receive it. The type of property being financed will influence key documents; however, the following are items that are consistent across…

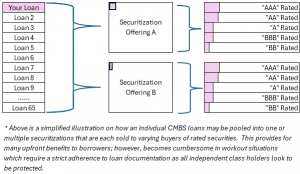

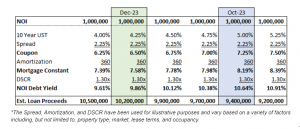

Read More >>CMBS loans have become popular in 2024 as regional and local banks have slowed or halted new loan production. For those that aren’t as familiar with the CMBS product, the loans are heavily structured and largely originated by lenders with little to no customer relationship. The loans are quickly sliced, diced, pooled and converted into…

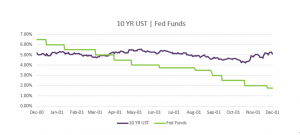

Read More >>While the Fed is an important driver in the economy, it isn’t the only factor that shapes long-term interest rates for commercial real estate. We saw interest rates move independently of the Fed’s actions in the year 2000. At that time, the Fed had abandoned their two year fight against inflation and turned on its…

Read More >>Santa came early for some commercial real estate owners who locked a rate in the past week. The 10YR US Treasury yields dipped then rallied last week, declining to 4.11% before bouncing back to current levels near 4.25%. Is this dip and then increase back to the prior week’s levels a sign of a…

Read More >>CRE Owners Catch a Break This past week, commercial real estate owners caught a huge break. The 10YR treasury yields fell almost 0.30% throughout the week, and are 0.80% lower than their high of ~5.00% in mid October. Not even Friday’s comments by Fed Chair Powell that “rate cuts are premature” stopped yields from…

Read More >>COMPANY

© 2019 PLUM Lending. All Rights Reserved. | Terms of Service | Privacy | Plum, Inc. dba Plum and/or Plum Lending