Blog

Comparing Commercial Real Estate Lenders

Commercial real estate (CRE) owners have many different lender and loan options. Choosing the right type of loan is a key part of your CRE portfolio strategy, and understanding the commercial lending landscape is the first step. The following are the most common types of commercial real estate lenders.

Banks

These include large national banks, as well as local and regional banks. Banks specialize in construction loans and short-term fixed rate loans, usually no longer than five years.

- Positives: Lower rates; more flexible prepayment options.

- Negatives: Shorter fixed-rate terms; full or partial recourse, meaning it’s the borrower’s personal responsibility to repay the loan if it defaults.

Life insurance companies

Many life insurance companies invest in real estate and offer commercial real estate loans. Life insurance loans can be longer term (10+ years), but their underwriting criteria tend to be more conservative. Life insurance lenders usually look for newer buildings and require a lower loan-to-value (LTV) of no more than 65%. Yield maintenance is the most common prepayment premium with life insurance companies. Learn more about prepayment premiums here.

- Positives: Longer fixed-rate loan terms; lower rates; good certainty of execution.

- Negatives: Prepayment terms are not as flexible as banks; more conservative on LTV and amortization.

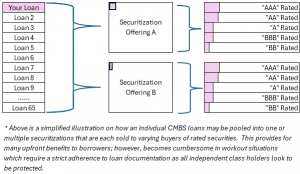

Conduits (CMBS)

Commercial mortgage-backed securities (CMBS) loans are made by commercial real estate lenders and then packaged together and sold to bond buyers as securities. CMBS lenders are more aggressive in terms of the amount of money that they will lend, and the loans are often non-recourse. The prepayment premium on CMBS loans is usually defeasance, and the closing costs tend to be higher than other types. CMBS loans are more common with experienced CRE investors who require larger loan amounts.

- Positives: Allows for higher LTV; loans are typically non-recourse.

- Negatives: High legal and closing costs; prepayment premiums are complicated and expensive; less certainty of execution at agreed-upon terms.

REITs

Real estate investment trusts (REITs), are companies that own or finance a variety of income-producing commercial real estate. REITs offer short-term loans, mezzanine loans, construction loans and equity financing. REITs tend to lend on bigger amounts and are best suited for experienced borrowers.

- Positives: Can be more aggressive than banks on non-recourse and LTV, especially for construction loans.

- Negatives: Higher cost and rates than banks; generally only offer short-term loans.

Credit unions

Credit unions are nonprofit, member-focused financial cooperatives. Credit unions will work with more unorthodox properties that are not appropriate for other commercial real estate lenders. These commercial real estate lenders usually work with smaller loan amounts, with unstabilized properties, and ones that are in transition.

- Positives: Low closing costs; more relaxed prepayment premiums; willingness to lend on lower loan amounts.

- Negatives: Tend to have a lower target loan size; smaller appetite for commercial real estate lending.

Private/hard money lenders

These lenders charge high interest rates for short-term loans, typically from six months to three years. Many borrowers look to hard money for interim, or bridge financing. These private investors can usually lend on any property type for any amount of money. Hard money is an expensive option for emergency situations like repairs, renovations, or a transition. They can, however, be executed quickly with minimal paperwork.

- Positives: Fast execution and flexibility regarding property type; oftentimes overlook tricky borrower circumstances and credit issues.

- Negatives: High interest rates (up to 10% – 18%); shorter terms than other lender types.

Government agencies

These agencies include HUD, Fannie Mae and Freddie Mac. A third-party underwriter will usually execute the loan on behalf of the government agency. These agencies only lend on multifamily properties.

- Positives: Agencies accept higher LTV; non-recourse; competitive rates.

- Negatives: Process can be cumbersome. Watch for prepayment terms.

SBA loans

These loans are written by independent lenders but are guaranteed by the Small Business Association (SBA). There are several different types of SBA loans and they are not a fit for every business owner. However, these long-term loans can be a good option for CRE owners who don’t qualify for more traditional CRE financing. SBA loans are specifically designed to grow a small business and are tied into the overall business, not just the commercial property. As such, they are for owner-occupied properties only.

- Positives: Longer terms; good option for owners who do not qualify for other lending sources.

- Negatives: Higher rates and closing costs; approval process can be cumbersome.

HOW TO DECIDE WHICH COMMERCIAL REAL ESTATE LENDERS ARE RIGHT FOR YOU:

The right lender for you largely depends on your property type and situation. The first task is to educate yourself on the CRE lending landscape and understand what types of lenders and loans you qualify for. Oftentimes a property will only be suitable for one lender, but in some cases a borrower will have several choices.

Second, determine and evaluate your property goals and overall portfolio strategy. How long do you intend to own your property? What are your risk preferences? How much complexity are you willing to deal with? Always take the time to understand the implications of the prepayment premium as a part of your overall financing decisions.

It pays to talk to a financing specialist as you think about which lender and loan is the best solution for your project. Contact us at Plum today to discuss your loan options, or if you need help evaluating your current situation.

Related

A quick, smooth loan closing begins before you reach out to a lender. It’s made possible by understanding the type of documentation lenders look for, and when, and in which format, they need to receive it. The type of property being financed will influence key documents; however, the following are items that are consistent across…

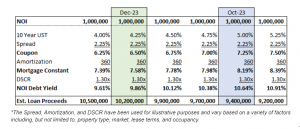

Read More >>CMBS loans have become popular in 2024 as regional and local banks have slowed or halted new loan production. For those that aren’t as familiar with the CMBS product, the loans are heavily structured and largely originated by lenders with little to no customer relationship. The loans are quickly sliced, diced, pooled and converted into…

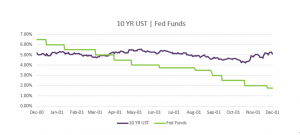

Read More >>While the Fed is an important driver in the economy, it isn’t the only factor that shapes long-term interest rates for commercial real estate. We saw interest rates move independently of the Fed’s actions in the year 2000. At that time, the Fed had abandoned their two year fight against inflation and turned on its…

Read More >>Santa came early for some commercial real estate owners who locked a rate in the past week. The 10YR US Treasury yields dipped then rallied last week, declining to 4.11% before bouncing back to current levels near 4.25%. Is this dip and then increase back to the prior week’s levels a sign of a…

Read More >>CRE Owners Catch a Break This past week, commercial real estate owners caught a huge break. The 10YR treasury yields fell almost 0.30% throughout the week, and are 0.80% lower than their high of ~5.00% in mid October. Not even Friday’s comments by Fed Chair Powell that “rate cuts are premature” stopped yields from…

Read More >>COMPANY

© 2019 PLUM Lending. All Rights Reserved. | Terms of Service | Privacy | Plum, Inc. dba Plum and/or Plum Lending