Blog

CRE, Interest Rates & Your Wallet

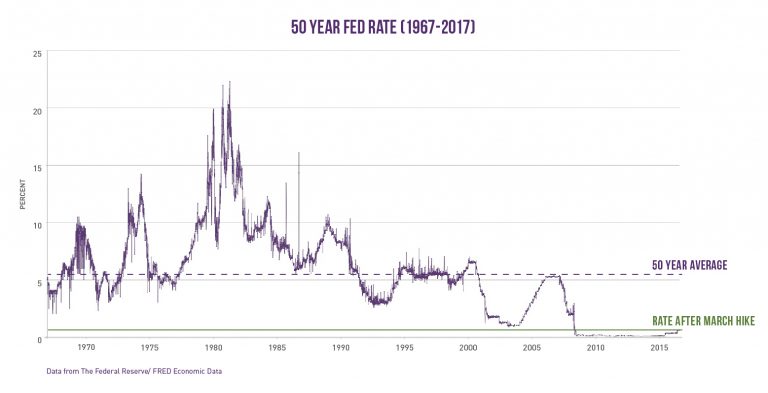

For nearly a decade, record-low interest rates have saved CRE owners a bundle, and made short-term, variable interest loans the CRE financing option of choice. While a short-term investment strategy made sense in the aftershocks of the Great Recession, it is a complacent strategy now. The cycle of historically low interest rates is coming to an end, and relying on the CRE investment strategies of the Obama era will likely hurt your wallet over the next few years.

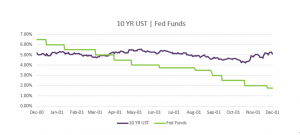

The Great Race on Rates

On August 26, 2016, Janet Yellen, Federal Reserve Chair, clearly indicated that rates are on the rise. She left the number of increases over the next few years open to speculation. The Fed has signaled for at least 3 Rate hikes in 2017 – one back in March, another expected in June, and a third likely in December. While rates are set to increase multiple times over the next number of years, the real question is, how fast will they rise after 2017? History has some answers. Highlighted below are two sections from the above graphic that demonstrate how rapidly they can change.

Interest Rates After the Dotcom Bubble

View 2000-2007 in the graph above.

The recession in the early 2000s was spurred on by the burst of the dotcom bubble, and the market crash after 9/11. This led to the Fed repeatedly reducing the rate to historically low levels, of around 1%. As the economy recovered, the Fed aggressively raised rates from their record low floor in June 2004. By July 2006, the rate was 4.25% higher, following 17 consecutive interest rate hikes.

Interest Rates After the Gulf War and Savings & Loan Crisis

View 1990-1997 in the graph above.

The US experienced a period of recession from 1990-92, caused in part by the oil crisis of 1990 and the subsequent instability in the Middle East due to the Gulf War. The failure of almost one third of the United States’ savings and loan institutions between 1986 and 1995, and the subsequent stagnation of the housing construction industry, were also key contributors. Between 1990 and 1995, we experienced a swing in rates of nearly 3%.

Your Wake Up Call: Change Your CRE Financing Strategy

The only time the Fed did not hike rates after growth out of a recession was during the Obama era.

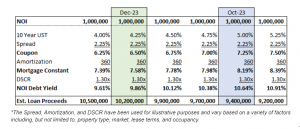

This was due to the unprecedented after-effects of the 2008 Financial Crisis, the fragility of the economy, and the global economic uncertainty. Simply put: the economy was not ready. But it is now. The Fed’s current path could be classified as aggressive. CRE investors could find themselves staring at a 3.5% rate by 2019. If the economy surpasses expectations, rates could go even higher. With each Fed rate rise, CRE investors could see a sizable chunk of revenue disappear. The chart below demonstrates potential losses through extra CRE loan payments.

Your Solution to Rising Rates?

The borrowing strategies of the past nine years no longer make fiscal sense for CRE investors. A borrower refinancing a 5-year loan in 2022 will likely be looking at a rate of 5.5% or above. Interest payments on variable interest rate loans will continue to rise. To that end, 20-year, fixed-rate loans, with no rate resets, will be more lucrative over the next decade.

Plum specializes in $1M to $25M long-term, fixed-rate loans. Try Plum Compare, to instantly calculate your savings on a 20-year, fixed-rate loan, compared to a traditional 5-year bank loan.

Related

A quick, smooth loan closing begins before you reach out to a lender. It’s made possible by understanding the type of documentation lenders look for, and when, and in which format, they need to receive it. The type of property being financed will influence key documents; however, the following are items that are consistent across…

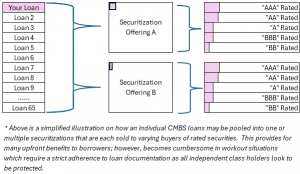

Read More >>CMBS loans have become popular in 2024 as regional and local banks have slowed or halted new loan production. For those that aren’t as familiar with the CMBS product, the loans are heavily structured and largely originated by lenders with little to no customer relationship. The loans are quickly sliced, diced, pooled and converted into…

Read More >>While the Fed is an important driver in the economy, it isn’t the only factor that shapes long-term interest rates for commercial real estate. We saw interest rates move independently of the Fed’s actions in the year 2000. At that time, the Fed had abandoned their two year fight against inflation and turned on its…

Read More >>Santa came early for some commercial real estate owners who locked a rate in the past week. The 10YR US Treasury yields dipped then rallied last week, declining to 4.11% before bouncing back to current levels near 4.25%. Is this dip and then increase back to the prior week’s levels a sign of a…

Read More >>CRE Owners Catch a Break This past week, commercial real estate owners caught a huge break. The 10YR treasury yields fell almost 0.30% throughout the week, and are 0.80% lower than their high of ~5.00% in mid October. Not even Friday’s comments by Fed Chair Powell that “rate cuts are premature” stopped yields from…

Read More >>COMPANY

© 2019 PLUM Lending. All Rights Reserved. | Terms of Service | Privacy | Plum, Inc. dba Plum and/or Plum Lending