Blog

Guide to Prepayment Premiums: What Are They and Why Do They Exist?

When looking at terms that are offered on a new loan, many borrowers consider the interest rate and the loan term, but they often overlook a critical component of the loan – the prepayment premium. Prepayment premiums allow lenders to offer longer term financing, but they can also restrict your ability to sell or refinance properties.

WHAT ARE PREPAYMENT PREMIUMS?

Most commercial real estate lenders who offer fixed-rate loans charge a prepayment premium. The premium is usually based on a percentage of the balance that remains on the loan. This is often the trade-off for receiving a low rate and longer term, with a lower or no-upfront loan fee. Rather than just a penalty, the prepayment premium is a part of the negotiation of a mortgage contract that allows you, the borrower, to get a better deal, if you want a long-term loan.

WHY DO THEY EXIST?

Think of a prepayment premium as the lender’s insurance against lost interest revenue. Mortgage lenders impose prepayment premiums because they stand to lose their revenue stream if the borrower pays off the loan before the agreed-upon time.

When you receive a fixed-rate loan, the lender is guaranteeing that even if the cost of money goes up, they will be protected at an agreed-upon rate for the life of the loan. If market rates go down or circumstances change, however, you as the borrower might like to repay the loan, and possibly refinance into a new loan with a lower interest rate. With a prepayment premium, the lender gets back some, or all, of the interest they would have received during the entire loan term. These prepayment premiums are all part of the loan negotiation. If you are trying to get a longer-term fixed rate loan, you should expect some sort of prepayment premium.

MOST COMMON TYPES OF PREPAYMENT PREMIUMS

Prepayment premiums come in many shapes and sizes. It’s good to know the differences when considering your loan options:

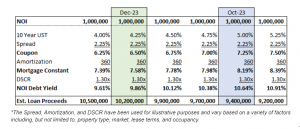

Yield Maintenance: Yield Maintenance is a formula based on the present value of remaining loan payments, multiplied by the difference between the loan interest rate and the rate on a US Treasury bond of the same duration. A good rule of thumb is that if rates go up, you’ll pay less of a yield maintenance fee.

Fixed Premium (“Step-Down”): This is a simple formula that represents a percentage of the then-existing loan balance at the time the loan is prepaid. For example, a typical 5,4,3,2,1 step-down imposes a 5% premium in year one, 4% in year two, 3% in year three and so on until the prepayment premium “burns off,” or is eliminated, near the end of the term.

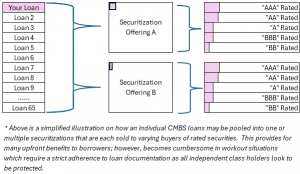

Defeasance: This type of arrangement is more common with commercial mortgage-backed security (CMBS) loans, where your mortgage is securitized with other loan holders and sold to bondholders. Defeasance is a complicated process where you substitute the loan with a portfolio of US Treasury bonds that essentially repay the lender at the same rate as your original loan. Defeasance has a lot of moving parts and requires legal, accounting and tax experts to execute.

No Premium: Lenders sometime offer no prepayment premium at all, but you’ll most likely pay for this lack of premium with a larger upfront loan fee, a higher interest rate, a variable rate (or floating rate) loan, or a shorter fixed-rate loan term.

HOW TO DECIDE IF A PREPAYMENT PREMIUM IS REASONABLE

Deciding what kind of prepayment premium is acceptable can affect the type of loan you can get and how you manage your asset. Some things to consider when entering into a new loan agreement include:

- How long do I intend on holding the property?

- How much interest rate risk am I willing to accept over the next several years?

- What is my exit strategy?

- Are the loan terms advantageous to a prospective purchaser who may be able to “assume” my loan if I sell the property?

WHAT YOU CAN DO

Always take the time to understand the implications of the prepayment premium as a part of your financing decisions:

- Carefully check the specific prepayment terms of any loan you are considering.

- Determine your commercial real estate asset strategy. Will you be holding the property long-term for cash-flow purposes, or will you be selling the property for profit in the near-term? Ensure that the prepayment premium aligns with your goals for the property.

- Contact us at Plum to discuss your loan options, or if you would like help evaluating your current financing situation.

Related

A quick, smooth loan closing begins before you reach out to a lender. It’s made possible by understanding the type of documentation lenders look for, and when, and in which format, they need to receive it. The type of property being financed will influence key documents; however, the following are items that are consistent across…

Read More >>CMBS loans have become popular in 2024 as regional and local banks have slowed or halted new loan production. For those that aren’t as familiar with the CMBS product, the loans are heavily structured and largely originated by lenders with little to no customer relationship. The loans are quickly sliced, diced, pooled and converted into…

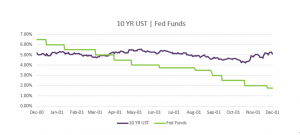

Read More >>While the Fed is an important driver in the economy, it isn’t the only factor that shapes long-term interest rates for commercial real estate. We saw interest rates move independently of the Fed’s actions in the year 2000. At that time, the Fed had abandoned their two year fight against inflation and turned on its…

Read More >>Santa came early for some commercial real estate owners who locked a rate in the past week. The 10YR US Treasury yields dipped then rallied last week, declining to 4.11% before bouncing back to current levels near 4.25%. Is this dip and then increase back to the prior week’s levels a sign of a…

Read More >>CRE Owners Catch a Break This past week, commercial real estate owners caught a huge break. The 10YR treasury yields fell almost 0.30% throughout the week, and are 0.80% lower than their high of ~5.00% in mid October. Not even Friday’s comments by Fed Chair Powell that “rate cuts are premature” stopped yields from…

Read More >>COMPANY

© 2019 PLUM Lending. All Rights Reserved. | Terms of Service | Privacy | Plum, Inc. dba Plum and/or Plum Lending