Blog

How is Cryptocurrency Affecting Commercial Real Estate?

Cryptocurrency is an exclusively digital currency that uses advanced cryptography for security 1. It is based on a ledger system that records and makes new transactions on the basis of previous ones, making them accessible to the public, but relatively unfalsifiable 2. The ledger system is called blockchain, and it has the potential to make an extraordinary impact on the Commercial Real Estate (CRE) industry. These impacts can be seen in altering current trends, the alleviation of existing challenges, as well as a significant threat to security in the industry.

Improved Property Search Procedures

The current procedures for searching and leasing properties in the CRE industry can be significantly improved by the influence of cryptocurrency and blockchain technology. Brokers, tenants, buyers and other players in the CRE industry currently use multiple listing services (MLS) to share and access property listing information. Besides being subscription based and not easily accessible3, this system makes it more difficult to find suitable properties. Additionally, the accuracy of the information listed is often at the discretion and preference of the brokers. As a result, there may be inaccurate, incomplete or fragmented information included in the listings 4,5.

With a blockchain based MLS, information from all listings can be integrated into a single decentralized system. With this, the inaccuracy and incomplete data entry due to human error can be avoided, as property owners and brokers can have more control over their data. This system will also lead to increased trust and reliability6. The overall benefit of this blockchain based MLS is translated into improvements on the details of property location and address, the age and state of the property, tenant details, rental rates, and even ownership history 7.

New Investment Vehicles

Cryptocurrency and blockchain can also bring new and exciting investment vehicles to the industry. In the past, stock traders have been able to trade company stocks, bonds, mutual funds and even commodities like oil and gold. But with cryptocurrency, there is an opportunity for trades to be made on commercial real estate properties as well. The world has started trading cryptos like Digix Gold Tokens 8 which are based on and backed up by physical gold bullions. Likewise, it’s not difficult to see how commercial real estate assets can be liquified and made into tradable tokens.

In addition to making it much easier to trade properties in this way, investors who do not possess sufficient capital to buy the assets as a whole can purchase bits and pieces of them. Cryptos like bitcoin and Ethereum can be traded in bits as small as one Satoshi (0.00000001 BTC 9). The same could also be true for CRE assets. This has a double positive effect because sellers of properties can also sell off their assets in small portions to willing buyers instead of looking for a single buyer.

Shorter and Cheaper Transactions

Because blockchain is based on a ledger confirmation system that includes virtually everyone in the network, the transactions are much faster to process. The system uses every user to validate the transaction and ensures a safe and tamperproof verification process. CRE transactions based on cryptocurrency framework will enjoy similar speed and ease of transaction processing. Additionally, the cost of processing transactions on the blockchain will be much lower than they are right now. The use of a decentralized blockchain network in CRE will also cut out costs incurred while using more centralized network costs. Inspection costs, registration and loan fees, and even property taxes could be reduced, or eliminated.

Potential Risks of Cryptocurrency in Commercial Real Estate

The biggest risk that cryptocurrency brings to CRE is the same that’s inherent in every industry where it’s used–security. For all the speed and security involved in its use for transaction processing, storing assets as cryptocurrency exposes the industry to a new form of financial theft by hackers. Several institutions have already fallen victim to this threat, like the hack of the Singapore based exchange, Dragon Ex 10. This is because unlike fiscal currency, cryptos are invisible, exclusively digital forms of currency, and that makes them vulnerable to hackers. As cryptocurrency becomes more integrated into the industry, CRE entities and investors will have to take additional precautions to protect themselves from the dangers. This is especially relevant now, since cryptos have not been fully adapted to the point of being insured by insurance companies.

The bottom line

Just like many other revolutionary changes, cryptocurrency has the potential to affect several parts of commercial real estate in a way that was previously inconceivable. With a blockchain based MLS, buyers have unfettered access to concise and accurate information on available properties. Additionally, buyers can have the option to purchase fractions of properties; transactions are processed far more quickly; and fees are manageable. With adequate security measures and protection on the part of transactions, cryptocurrency can lead to a very favorable change in the commercial real estate industry.

PLUM Lending is a full service commercial real estate lender that provides creative structured finance solutions for all property types. We specialize in the capitalization of middle-market commercial real estate properties nationwide with a focus on secondary markets. We provide borrowers with capital through our various direct lending programs as well as access to construction financing, mezzanine capital, and preferred and join-venture equity investments.

References

- https://blockgeeks.com/guides/what-is-cryptocurrency/

- https://blockgeeks.com/guides/what-is-blockchain-technology/

- https://btcmanager.com/rex-decentralizing-and-distrupting-real-estate-listing-services/?q=/rex-decentralizing-and-distrupting-real-estate-listing-services/&

- Ibid

- Ibid

- Ibid

- https://blogs.wsj.com/cio/2015/12/22/blockchain-real-estate-industry-could-see-benefits-in-2016/

- https://digix.global/

- https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=2&cad=rja&uact=8&ved=2ahUKEwiWmdKt3sniAhWztXEKHaFLB0gQFjABegQIDBAF&url=https%3A%2F%2Fbitcoinist.com%2Fsatoshi-bitcoin-worth-5-venezuelan-bolivar%2F&usg=AOvVaw0AIjoSPXhMjSCybzNzbFTW

- https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&cad=rja&uact=8&ved=2ahUKEwirw5yG4cniAhUHRBUIHSE6BNIQFjAAegQIAhAB&url=https%3A%2F%2Fwww.coindesk.com%2Fsingapore-based-crypto-exchange-dragonex-has-been-hacked&usg=AOvVaw0hZWo4oVkxGWvBQiGIMq6b

Related

A quick, smooth loan closing begins before you reach out to a lender. It’s made possible by understanding the type of documentation lenders look for, and when, and in which format, they need to receive it. The type of property being financed will influence key documents; however, the following are items that are consistent across…

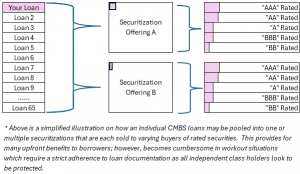

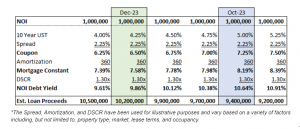

Read More >>CMBS loans have become popular in 2024 as regional and local banks have slowed or halted new loan production. For those that aren’t as familiar with the CMBS product, the loans are heavily structured and largely originated by lenders with little to no customer relationship. The loans are quickly sliced, diced, pooled and converted into…

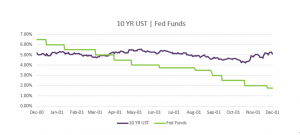

Read More >>While the Fed is an important driver in the economy, it isn’t the only factor that shapes long-term interest rates for commercial real estate. We saw interest rates move independently of the Fed’s actions in the year 2000. At that time, the Fed had abandoned their two year fight against inflation and turned on its…

Read More >>Santa came early for some commercial real estate owners who locked a rate in the past week. The 10YR US Treasury yields dipped then rallied last week, declining to 4.11% before bouncing back to current levels near 4.25%. Is this dip and then increase back to the prior week’s levels a sign of a…

Read More >>CRE Owners Catch a Break This past week, commercial real estate owners caught a huge break. The 10YR treasury yields fell almost 0.30% throughout the week, and are 0.80% lower than their high of ~5.00% in mid October. Not even Friday’s comments by Fed Chair Powell that “rate cuts are premature” stopped yields from…

Read More >>COMPANY

© 2019 PLUM Lending. All Rights Reserved. | Terms of Service | Privacy | Plum, Inc. dba Plum and/or Plum Lending