PLUM Insights

Industrial Real Estate: What's New in 2019?

The industrial sector of commercial real estate has undergone many changes over the past two decades. Before these changes, industrial real estate has always been a significantly profitable investment. However, changes like the rise of e-commerce, the completion of the Panama Canal expansion, and the recent legalization of cannabis are set to further increase the profitability of the sector. The introduction of these changes and the growth they bring make industrial real estate an especially interesting consideration for CRE investors.

What is Different About Industrial Real Estate?

If you consider that virtually every product is first manufactured before distribution, it’s easy to see how reliant we are upon industrial real estate. It’s also worth considering that the real estate sector, in general, has consistently outperformed the overall market by at least 8.6% over the last 20 years 1. Specifically, the industrial real estate sector has risen as high as 12.8% at various times over the past five years 2. With these spectacular figures, the question must be asked: What is responsible for all this growth?

Drivers Affecting Growth in This Sector

Several factors can be credited with the boom currently happening in the industrial sector. Among the more prominent factors are the rise of e-commerce, the completion of the Panama Canal expansion, the on-shoring of US manufacturers, the burgeoning interest in cryptocurrency, and legalization and increase in demand of cannabis.

- E-Commerce: It’s not news that e-commerce giants like Amazon and eBay have changed the face of traditional retail. However, smaller, less known companies are also making their debut in big ways. Thanks to the internet, many companies now choose cyber-stores to store their products before distribution, as opposed to brick and mortar establishments. The increase of distributors also means an increase in production, which then increases demand for industrial real estate.

- Panama Canal Expansion: The Panama Canal expansion project was completed in 2016 3, and has since begun to influence the industrial real estate market. Since its completion, the travelling time between the Atlantic Ocean ports and Asia has been reduced by up to 16 days. Additionally, since the canal can handle shipping containers that are twice the traditional size, more importing and exporting opportunities have been created for companies willing to trade with Asia 4. An increase in import and export translates to increase demand for industrial real estate, particularly in areas around the ports, and this accounts for the increased figures explored earlier.

- On-shoring of US Manufacturers: Technology has also been a huge contributor to the growth being experienced in the industrial sector. The rise of technology has replaced many workers with robots, making it easier and cheaper to manufacture products in the United States, as opposed to trying to get lower costs by having them imported.

- Introduction of Cryptocurrency: The rising interest in cryptocurrency is also creating more demand for suitable industrial space. Those in charge of storing and updating the electronic ledgers associated with cryptocurrency transactions (coined bitcoin miners) need appropriate industrial spaces that can store their equipment and provide the proper infrastructure needed to support their technology.

- Cannabis: As mentioned earlier, Cannabis has made a significant input into the current growth in the industrial real estate sector. In every state that it’s been legalized, industrial real estate rents are reported to have risen exponentially. In Denver, it’s seen a 33% rise from the first quarter of 2014, until the second quarter of 2017. In Seattle and Portland, rent rates have risen by 27% 5. There is no telling how much more growth cannabis can drive in the sector since its growth is contingent on the availability of industrial real estate properties.

The Most Stable Markets and How They Provide New Opportunities for Investors

The most stable industrial markets have typically been recognized as Southern California, Atlanta, Chicago, Dallas, New Jersey, Houston, Eastern Pennsylvania, as well as other areas within proximity to large population centers and multiple access points (major roadways, airports, train stations, et cetera). However, this is a shifting model as is demonstrated by the factors listed above. Even though the industrial real estate market is subject to ebb and flow, like other investment vehicles, these new demand factors are shifting the tide in favor of investors in this sector. They make industrial properties a strong consideration for property owners looking to diversify their return on investments. If you’re considering an acquisition or refinance of industrial property, PLUM can help you.

PLUM Lending is a full service commercial real estate lender that provides creative structured finance solutions for all property types. We specialize in the capitalization of middle-market commercial real estate properties nationwide with a focus on secondary markets. We provide borrowers with capital through our various direct lending programs as well as access to construction financing, mezzanine capital, and preferred and join-venture equity investments.

References

- https://www.investopedia.com/ask/answers/060415/what-average-annual-return-typical-long-term-investment-real-estate-sector.asp

- https://blog.stewart.com/stewart/2016/08/09/total-industrial-property-returns-12-72-percent-12-months-ending-june-2016-8-93-percent-average-annual-return-since-2001/

- https://en.wikipedia.org/wiki/Panama_Canal_expansion_project

- https://nowthatslogistics.com/panama-canal-expansion-facilitates-asia-east-trade/

- https://www.greenbaumlaw.com/insights-publications-The_Business_of_Marijuana-How_Will_It_Affect_The_Real_Estate_Sector.html

Related

A quick, smooth loan closing begins before you reach out to a lender. It’s made possible by understanding the type of documentation lenders look for, and when, and in which format, they need to receive it. The type of property being financed will influence key documents; however, the following are items that are consistent across…

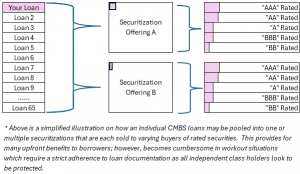

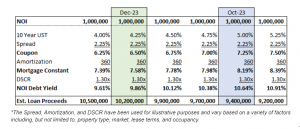

Read More >>CMBS loans have become popular in 2024 as regional and local banks have slowed or halted new loan production. For those that aren’t as familiar with the CMBS product, the loans are heavily structured and largely originated by lenders with little to no customer relationship. The loans are quickly sliced, diced, pooled and converted into…

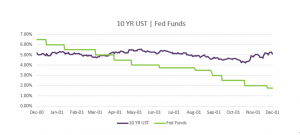

Read More >>While the Fed is an important driver in the economy, it isn’t the only factor that shapes long-term interest rates for commercial real estate. We saw interest rates move independently of the Fed’s actions in the year 2000. At that time, the Fed had abandoned their two year fight against inflation and turned on its…

Read More >>Santa came early for some commercial real estate owners who locked a rate in the past week. The 10YR US Treasury yields dipped then rallied last week, declining to 4.11% before bouncing back to current levels near 4.25%. Is this dip and then increase back to the prior week’s levels a sign of a…

Read More >>CRE Owners Catch a Break This past week, commercial real estate owners caught a huge break. The 10YR treasury yields fell almost 0.30% throughout the week, and are 0.80% lower than their high of ~5.00% in mid October. Not even Friday’s comments by Fed Chair Powell that “rate cuts are premature” stopped yields from…

Read More >>COMPANY

© 2019 PLUM Lending. All Rights Reserved. | Terms of Service | Privacy | Plum, Inc. dba Plum and/or Plum Lending