Blog

The People Involved in Your Commercial Real Estate Loan

Commercial lending is a team sport and there are many players involved in your loan. Knowing who they are and what they do can help you get the best service and most efficient process. The following are some of the people you will work with as you secure your commercial real estate loan.

Originator

The primary role of the originator is to work directly with you to identify appropriate loan products and navigate your loan through closing. They work with the various parties involved in your loan and are ultimately responsible for ensuring the success of the transaction. The originator is your point-person and will stay in close contact with you throughout the process.

Underwriter

The underwriter’s main responsibility is to evaluate the viability of the commercial real estate loan through verification of the initially presented property and borrower information, and to prepare and present the loan to the lender’s credit committee for approval. The underwriter also works closely with the loan closing team to ensure a smooth closing.

Loan Closer

The loan closer coordinates all the components of the closing process and ensures all conditions of the commercial real estate loan are met. Loan closers work with the title/escrow company to ensure that all parties sign appropriate loan documents and that the lender’s security interest is perfected. They review and approve documentation from outside vendors (such as ensuring that the owner has appropriate insurance on the property), and work with the lender’s treasury department to prepare the loan for funding.

Appraiser

Appraisers provide objective and unbiased opinions about the value of the property. Each appraisal involves careful analysis of market information, research into comparable sales, and a property inspection. Appraisers must follow the Uniform Standards of Professional Appraisal Practice which requires them to provide an accurate, neutral and unprejudiced opinion. The appraisal is ordered either directly by the lender, or by a firm on the lender’s behalf, to ensure that the appraiser has no conflict of interest in providing the report. Keep in mind that lenders will not accept reports originally ordered by the property owner.

Engineer/Inspector

Engineers are hired by the lender for a variety of reasons, such as to conduct environmental research, provide a property condition report, or provide a seismic report (if the property is in an area that is identified to be prone to earthquakes). A Phase I Environmental Report is the minimum standard for most lenders and it ensures that the lender’s collateral is free from any environmental issues. For properties with suspected environmental issues, a Phase II report and/or remediation may be required. Engineers may also test systems of the property, evaluate the structural components, and cite any maintenance issues. Depending on the property type, an engineer will inspect the fire, HVAC, elevator, and other mechanical systems to ensure acceptable quality of the lender’s collateral.

Surveyor

A survey may not be required for all loans. A lender may waive the survey requirement if the title company is willing to delete the survey exception from the title policy. However, property owners greatly benefit by ordering a land and building survey performed by a licensed, professional surveyor. Among the things a survey does is confirm appropriate boundary lines of a property, identify all easements and other agreements that might give other parties rights across your parcel of land, and note whether any buildings violate zoning laws.

Title/Escrow Company

A title insurance company is responsible for ensuring that all the documents related to the sale or refinance of a property are in order before a real estate transaction is executed. They will conduct title searches and make sure all liens have been satisfied and that no lien holders have outstanding claims on the property. While you as the borrower will benefit from an owner’s policy of title insurance – which generally protects your investment in the property from title issues – the lender will also require you to get a lender’s policy of title insurance, which protects the lender’s investment from title defects. Title companies also commonly act as escrow officers in commercial real estate transactions. An escrow officer holds documents or money as a part of the transaction and according to the instructions of the parties.

YOUR ROLE AS THE BORROWER

Knowledge is power. Besides providing accurate and thorough information on the property and your situation, you should take time to understand the entire commercial real estate loan process and everyone’s roles. You, as the borrower, are one piece of a larger puzzle. Make sure that each person comes with either the proper certification or good references.

Rely on the experts. Talk to a real estate financing company or other real estate professional who can guide you and answer any questions. The loan process can seem daunting, so be sure to ask questions along the way. Contact Plum today to discuss your loan options, or if you need help assessing your situation.

Related

A quick, smooth loan closing begins before you reach out to a lender. It’s made possible by understanding the type of documentation lenders look for, and when, and in which format, they need to receive it. The type of property being financed will influence key documents; however, the following are items that are consistent across…

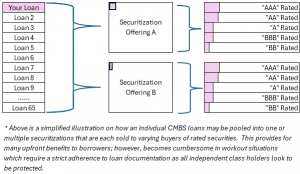

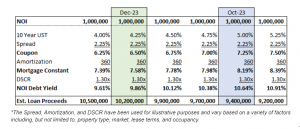

Read More >>CMBS loans have become popular in 2024 as regional and local banks have slowed or halted new loan production. For those that aren’t as familiar with the CMBS product, the loans are heavily structured and largely originated by lenders with little to no customer relationship. The loans are quickly sliced, diced, pooled and converted into…

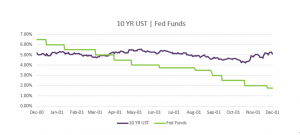

Read More >>While the Fed is an important driver in the economy, it isn’t the only factor that shapes long-term interest rates for commercial real estate. We saw interest rates move independently of the Fed’s actions in the year 2000. At that time, the Fed had abandoned their two year fight against inflation and turned on its…

Read More >>Santa came early for some commercial real estate owners who locked a rate in the past week. The 10YR US Treasury yields dipped then rallied last week, declining to 4.11% before bouncing back to current levels near 4.25%. Is this dip and then increase back to the prior week’s levels a sign of a…

Read More >>CRE Owners Catch a Break This past week, commercial real estate owners caught a huge break. The 10YR treasury yields fell almost 0.30% throughout the week, and are 0.80% lower than their high of ~5.00% in mid October. Not even Friday’s comments by Fed Chair Powell that “rate cuts are premature” stopped yields from…

Read More >>COMPANY

© 2019 PLUM Lending. All Rights Reserved. | Terms of Service | Privacy | Plum, Inc. dba Plum and/or Plum Lending