Blog

Uncertain Economic Environment Makes Now a Good Time to Consider CRE Refinancing

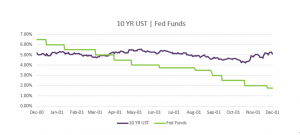

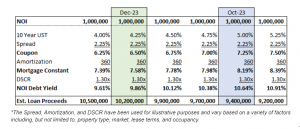

For many commercial real estate investors, the current economic outlook can pose challenges. As the Fed raises interest rates, existing commercial real estate investors may be adversely affected when it comes time to refinance. The rising rate environment could make it more difficult for those with highly leveraged properties to obtain financing, so planning farther ahead is a good idea.

Financing difficulties

As interest rates rise, the DSCR (debt service coverage ratio) goes down. This makes it more difficult to borrow, as higher rates make it more challenging for banks and other lenders to justify lending money for real estate projects. To demonstrate this, look no further than the CRE investors who have been rushing to get their loans refinanced over the last year — data shows rising total loans and interest rates.

Keep in mind, rising interest rates could also lead to an increase in cap rates. Such an increase could lead to lower valuations and a decreased ability to borrow. Furthermore, a rise in rates can contribute to an increase in the cost of loans. After historical lows, rates are likely to keep rising. Many CRE investors are taking action now.

Flattening yield curve presents risk

In addition to rising rates, another perhaps bigger risk is a recession. A flattening yield curve, which indicates that short-term rates are rising faster than long-term rates, suggests that the market thinks economic growth and inflation are not sustainable in the long-term and could drop in the near future. This pattern could also lead to an inverted yield curve, which has historically indicated an impending economic downturn.

If a recession happens, CRE investors may be hit hard, and credit could dry up. For investors who have debt coming due at a time of a recession, refinancing could be harder to secure. Refinancing now can help investors avoid these problems and limit an investor’s exposure.

What you can do…

One suggestion for landlords to hedge against tenant renewal issues down the road for those in a softening market is to renegotiate rents now — and perhaps boost rents in a slow-growing-rate environment. If you’re getting sufficient cash flow, the current trends in the market might not affect you as much. But if you have highly leveraged properties, it’s time to revisit your long-term investment plan.

On the refinancing side, landlords using debt capital to finance acquisitions or portfolios should make sure they do not have a balloon payment during a downturn, when cashflow or the ability to service the debt is uncertain.

We can’t say whether short-term or long-term rates will rise, but owners should think about converting short-term debt into long-term debt — something banks typically don’t provide. Converting to long-term debt is a step that can help reduce uncertainty around the profits in a project and let investors rest easy.

Final Considerations

The rate environment and economy are unpredictable. However, there are steps you can take to make good investment decisions as a property investor — especially with a lender who can offer a full range of lending options.

Related

A quick, smooth loan closing begins before you reach out to a lender. It’s made possible by understanding the type of documentation lenders look for, and when, and in which format, they need to receive it. The type of property being financed will influence key documents; however, the following are items that are consistent across…

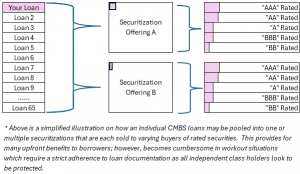

Read More >>CMBS loans have become popular in 2024 as regional and local banks have slowed or halted new loan production. For those that aren’t as familiar with the CMBS product, the loans are heavily structured and largely originated by lenders with little to no customer relationship. The loans are quickly sliced, diced, pooled and converted into…

Read More >>While the Fed is an important driver in the economy, it isn’t the only factor that shapes long-term interest rates for commercial real estate. We saw interest rates move independently of the Fed’s actions in the year 2000. At that time, the Fed had abandoned their two year fight against inflation and turned on its…

Read More >>Santa came early for some commercial real estate owners who locked a rate in the past week. The 10YR US Treasury yields dipped then rallied last week, declining to 4.11% before bouncing back to current levels near 4.25%. Is this dip and then increase back to the prior week’s levels a sign of a…

Read More >>CRE Owners Catch a Break This past week, commercial real estate owners caught a huge break. The 10YR treasury yields fell almost 0.30% throughout the week, and are 0.80% lower than their high of ~5.00% in mid October. Not even Friday’s comments by Fed Chair Powell that “rate cuts are premature” stopped yields from…

Read More >>COMPANY

© 2019 PLUM Lending. All Rights Reserved. | Terms of Service | Privacy | Plum, Inc. dba Plum and/or Plum Lending