Blog

Climate Change and Resilience in Commercial Real Estate

With increased global temperatures, changes in rainfall, and warming oceans, climate change is on the rise. And the effects of climate change – drought, wildfires, hurricanes, floods, and winter storms – can keep a commercial property owner awake at night. When disaster strikes, it strikes property. The damage is usually overwhelmingly expensive to both commercial property owners and cities, and both are taking proactive steps to incorporate resilience measures to tackle climate change.

Commercial Property and Government

While your first instinct as an owner is to protect your commercial property and investment, governments are getting ahead of disasters and protecting their cities.

For example, the City of Austin has set a 140-gallon-per-capita daily water goal and revised water conservation code to address long-term drought conditions. Seattle provides incentives and technical assistance for installing green roofs to absorb more intense rainfall. And in New York, a dozen new laws were passed to make new construction in the floodplain more resilient to strong storms and associated flooding.

Proactive Measures for Property Owners

Almost always, government policies impact property owners. But from addressing energy use, to increasing water conservation measures and reducing carbon emissions, the real estate industry is adopting measures of its own to balance between government compliance and long-term costs, such as:

- Installing backup and on-site power

- Investing in high-quality construction to withstand risks (often above code)

- Avoiding construction in high-risk areas

In all cases, the best approach is the proactive approach. Taking action and getting in front of emergencies – including reviewing insurance policies and coverages – is the best way to minimize the effects of Mother Nature when she strikes.

Related

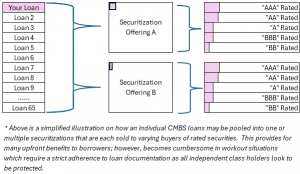

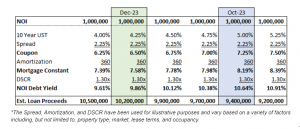

CMBS loans have become popular in 2024 as regional and local banks have slowed or halted new loan production. For those that aren’t as familiar with the CMBS product, the loans are heavily structured and largely originated by lenders with little to no customer relationship. The loans are quickly sliced, diced, pooled and converted into…

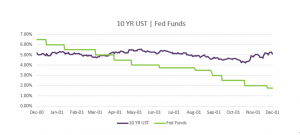

Read More >>While the Fed is an important driver in the economy, it isn’t the only factor that shapes long-term interest rates for commercial real estate. We saw interest rates move independently of the Fed’s actions in the year 2000. At that time, the Fed had abandoned their two year fight against inflation and turned on its…

Read More >>Santa came early for some commercial real estate owners who locked a rate in the past week. The 10YR US Treasury yields dipped then rallied last week, declining to 4.11% before bouncing back to current levels near 4.25%. Is this dip and then increase back to the prior week’s levels a sign of a…

Read More >>CRE Owners Catch a Break This past week, commercial real estate owners caught a huge break. The 10YR treasury yields fell almost 0.30% throughout the week, and are 0.80% lower than their high of ~5.00% in mid October. Not even Friday’s comments by Fed Chair Powell that “rate cuts are premature” stopped yields from…

Read More >>Portland, OR is a PLUM market due to its sustainability initiatives, diversified job market, and relative affordability compared to other west coast cities. The industrial market in Portland has been the city’s top-performing sector over the past three years, with asking rents up approximately 25% from pre-COVID levels. Click Here to Download Full Market…

Read More >>CAPABILITIES

COMPANY

© 2019 PLUM Lending. All Rights Reserved. | Terms of Service | Privacy | Plum, Inc. dba Plum and/or Plum Lending