Blog

PLUM Welcomes Shine Cheng

PLUM is pleased to announce the addition of Shine Cheng, Senior Director of Underwriting. Shine is located at our San Francisco headquarters and brings a wealth of expertise to our growing team of commercial real estate finance professionals. Shine will lead underwriting operations and financial due diligence for a diverse set of commercial real estate assets and transactions across the U.S.

Shine brings close to 10 years of commercial real estate underwriting experience to the team. Before joining PLUM, she was Sr. Director and Sr. Financial Associate at Colliers International, where she supported debt and equity transactions for industrial, retail, office, and multifamily properties. Prior to that, at Savills Studley, Shine advised domestic and international institutional clients on investing and financing for transactions totaling over $1.5B in both primary and secondary/tertiary markets. In her earlier experience, she handled underwriting, due diligence and closing of more than $900 million in debt and equity for Colony Capital, CorAmerica Capital, and George Smith Partners.

Shine holds a B.S in Public Policy, Management and Planning with a concentration in Real Estate Development from USC.

PLUM specializes in the capitalization of middle-market commercial real estate properties nationwide. We deliver creative and customized direct lending programs and a full array of loan options for all commercial property types.

Related

A quick, smooth loan closing begins before you reach out to a lender. It’s made possible by understanding the type of documentation lenders look for, and when, and in which format, they need to receive it. The type of property being financed will influence key documents; however, the following are items that are consistent across…

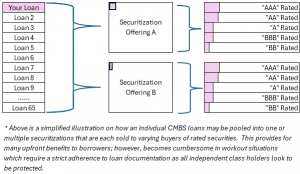

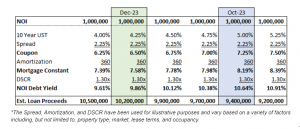

Read More >>CMBS loans have become popular in 2024 as regional and local banks have slowed or halted new loan production. For those that aren’t as familiar with the CMBS product, the loans are heavily structured and largely originated by lenders with little to no customer relationship. The loans are quickly sliced, diced, pooled and converted into…

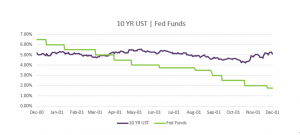

Read More >>While the Fed is an important driver in the economy, it isn’t the only factor that shapes long-term interest rates for commercial real estate. We saw interest rates move independently of the Fed’s actions in the year 2000. At that time, the Fed had abandoned their two year fight against inflation and turned on its…

Read More >>Santa came early for some commercial real estate owners who locked a rate in the past week. The 10YR US Treasury yields dipped then rallied last week, declining to 4.11% before bouncing back to current levels near 4.25%. Is this dip and then increase back to the prior week’s levels a sign of a…

Read More >>CRE Owners Catch a Break This past week, commercial real estate owners caught a huge break. The 10YR treasury yields fell almost 0.30% throughout the week, and are 0.80% lower than their high of ~5.00% in mid October. Not even Friday’s comments by Fed Chair Powell that “rate cuts are premature” stopped yields from…

Read More >>COMPANY

© 2019 PLUM Lending. All Rights Reserved. | Terms of Service | Privacy | Plum, Inc. dba Plum and/or Plum Lending